Preqin Pro is a browser-based data platform that inform institutional investors, funds managers, service providers, and other industry professionals with insights on the alternative asset industry. Preqin first started collecting data in the Private Equity space in 2003, and has expanded over the years to other alternative asset classes such as Real Estate, Hedge Funds, Infrastructure, Private Debt, Natural Resources, and secondary markets.

As part of the redesign / rebrand that began in 2017, the company wanted to revamp the browser platform and streamline workflows to keep users engaged. As a Product Designer collaborating with other designers, product owners, and engineers based in London, I was responsible to rethink about the functionality and user flows of criteria-based searches.

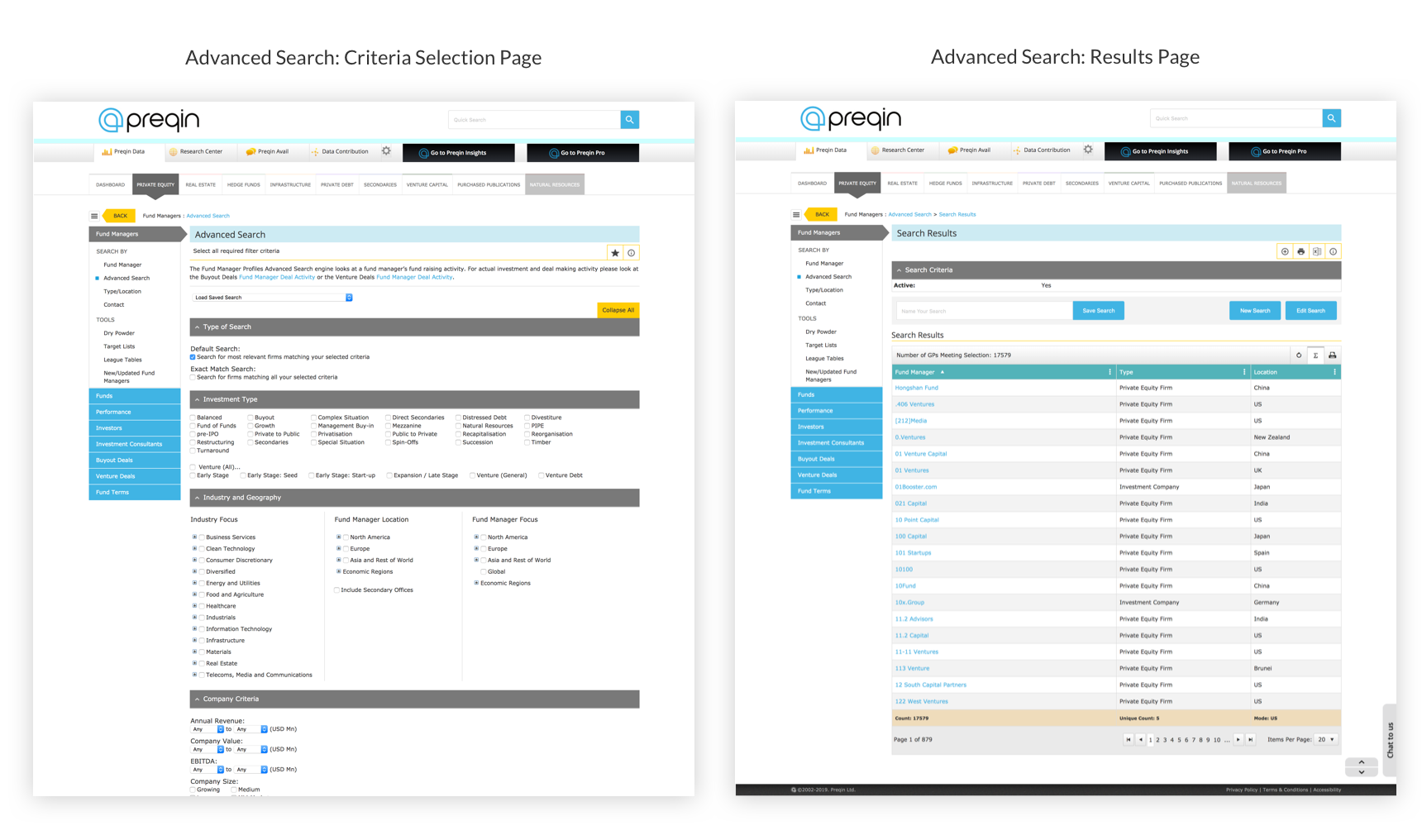

When customers want to find something from a large universe by specifying particular parameters and criteria, they gravitate toward using an advanced search. Advanced Search is a heavily used feature on Preqin where customers would narrow down multiple databases according to stategy, location, assets under management, user type, and several other factors.

However, the platform began covering multiple asset classes where each asset class tab ended up having repetitive filtering mechanisms which led to customers needing to export multiple searches at once and manipulating the data offline via excel. For example, if a customer wanted to retrieve a list of "Investors in Private Equity and Real Estate that focus on Buyout and Core-Plus strategies with a geographic focus on Europe and Asia", the customer would need to separately navigate to the Private Equity and Real Estate databases, run each advance search, export those respective lists onto excel, and then merge those 2 spreadsheets according to matching profile IDs to formulate a final list of investors that satisfies all criteria.

As more and more of our customers seek other asset classes in order to diversify their investments, this repetitive process has resulted in more legwork pushed toward the customer-end and has become critical point of friction in their workflow.

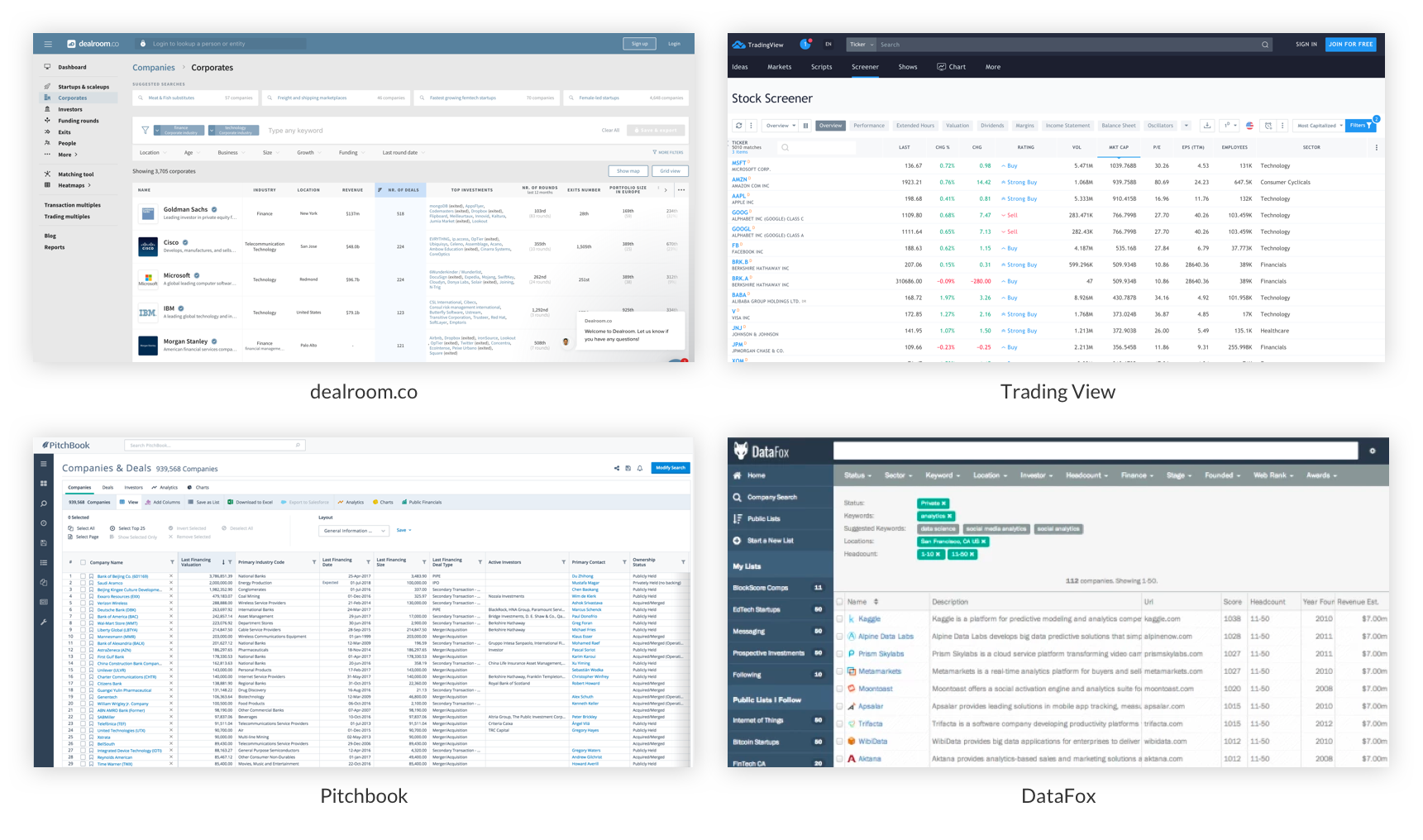

In order to gain more insight and understand how our customers approach filtering criteria, I performed a competitive analysis of other financial data providers:

A common observation across these four examples was that all advance search functionality was centralized into one area and all available filters are clearly displayed to quickly manipulate the selected list (universe). In our previous advance search, we created a separate advanced search for each asset class which has led to repetitious user flows and has prevented any type of cross-asset class analysis.

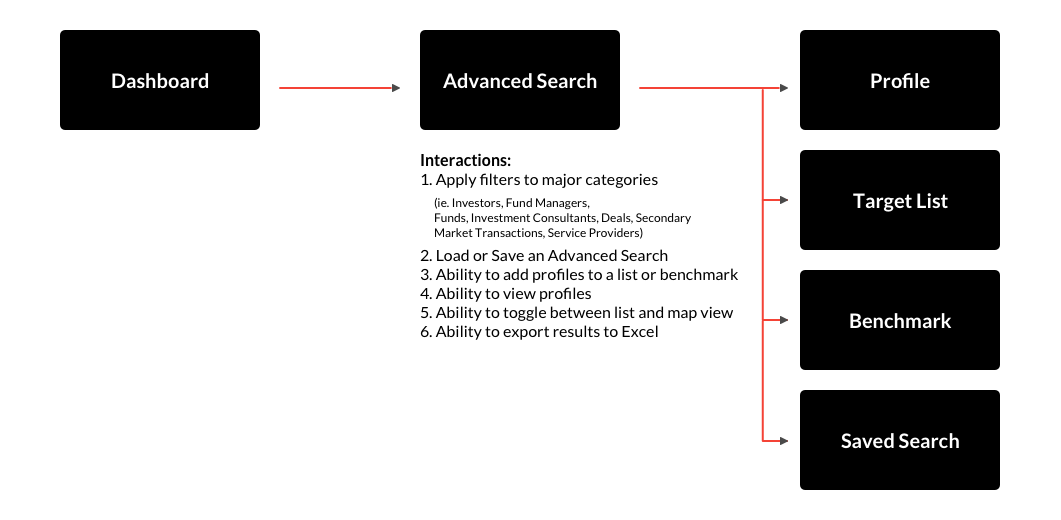

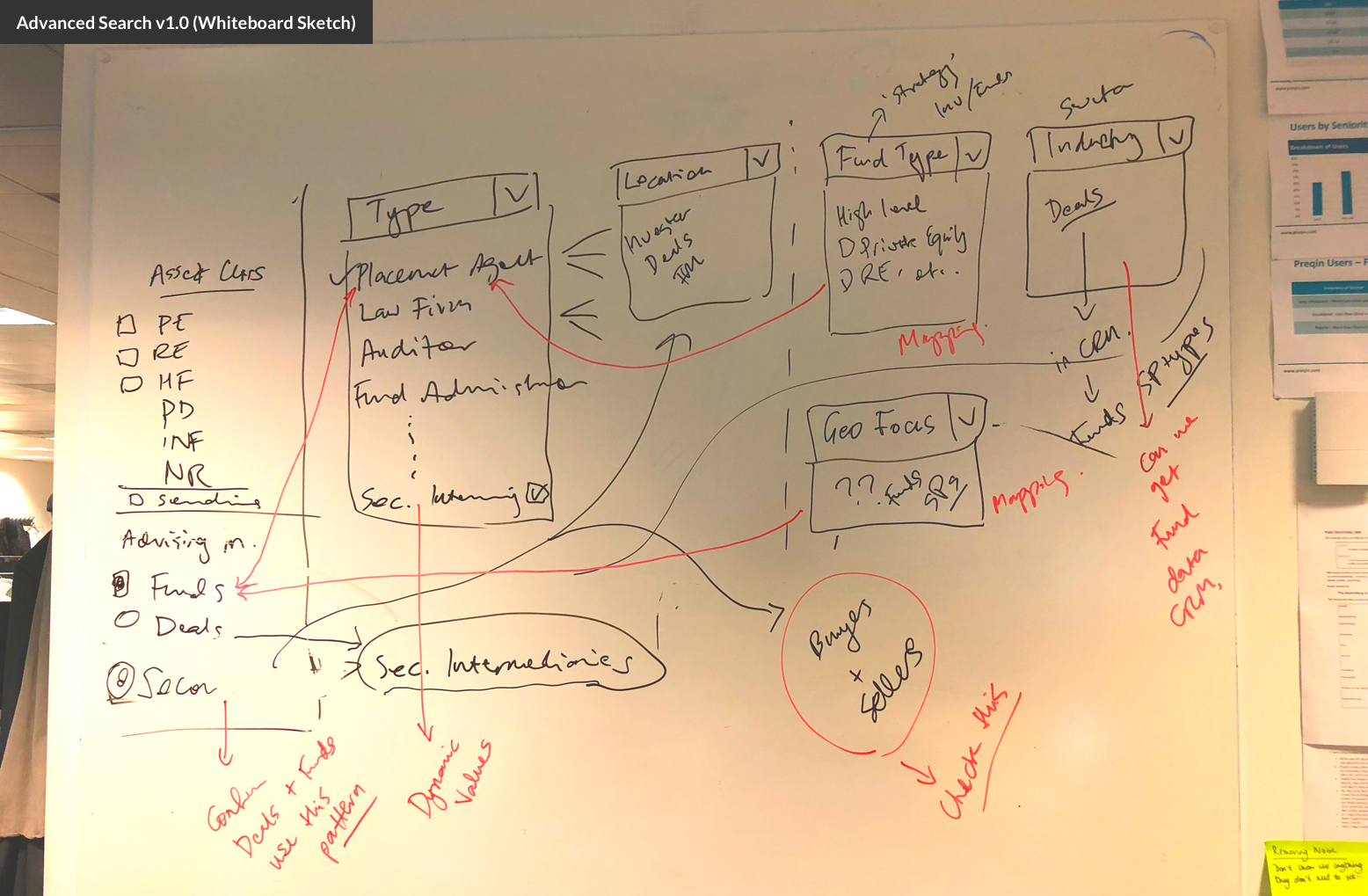

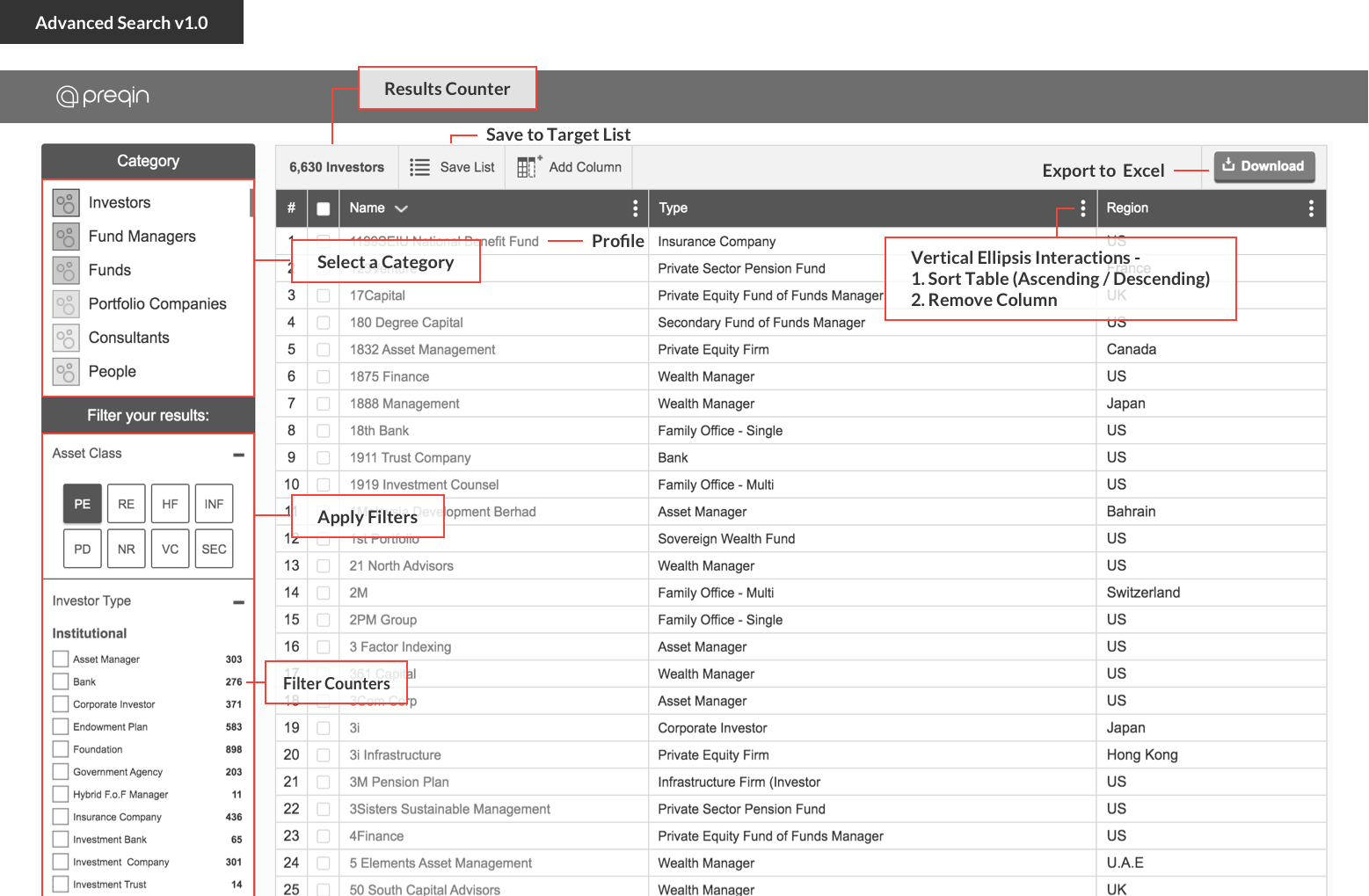

By conducting a competitive analysis of other financial service providers and reviewing customer feedback, the first iteration focused on centralizing all the advance searches that originally separated into tabs into one area. The first iteration allowed users to select a particular universe (e.g. Investors, Fund Managers, Funds, Investment Consultants, etc.) and then apply filters according to that category. Similarly to UI patterns that you may encounter in popuplar e-commerce / retail sites, the filters were located within the side navigation and filter counters would dynamically change based on each applied filter

Feedback that we received from clients and senior stakeholders was that although the side filters was a common / recognizable pattern, customers would be constantly scrolling up & down the page to find a particular filter. Another comment from customers was that they would actually like to see more data up-front rather than qualitative metrics such as geography and location. For instance, if we were looking at the 'Funds' Advance Search, then my default columns would pertain to more about the performance and relative metrics about that fund.

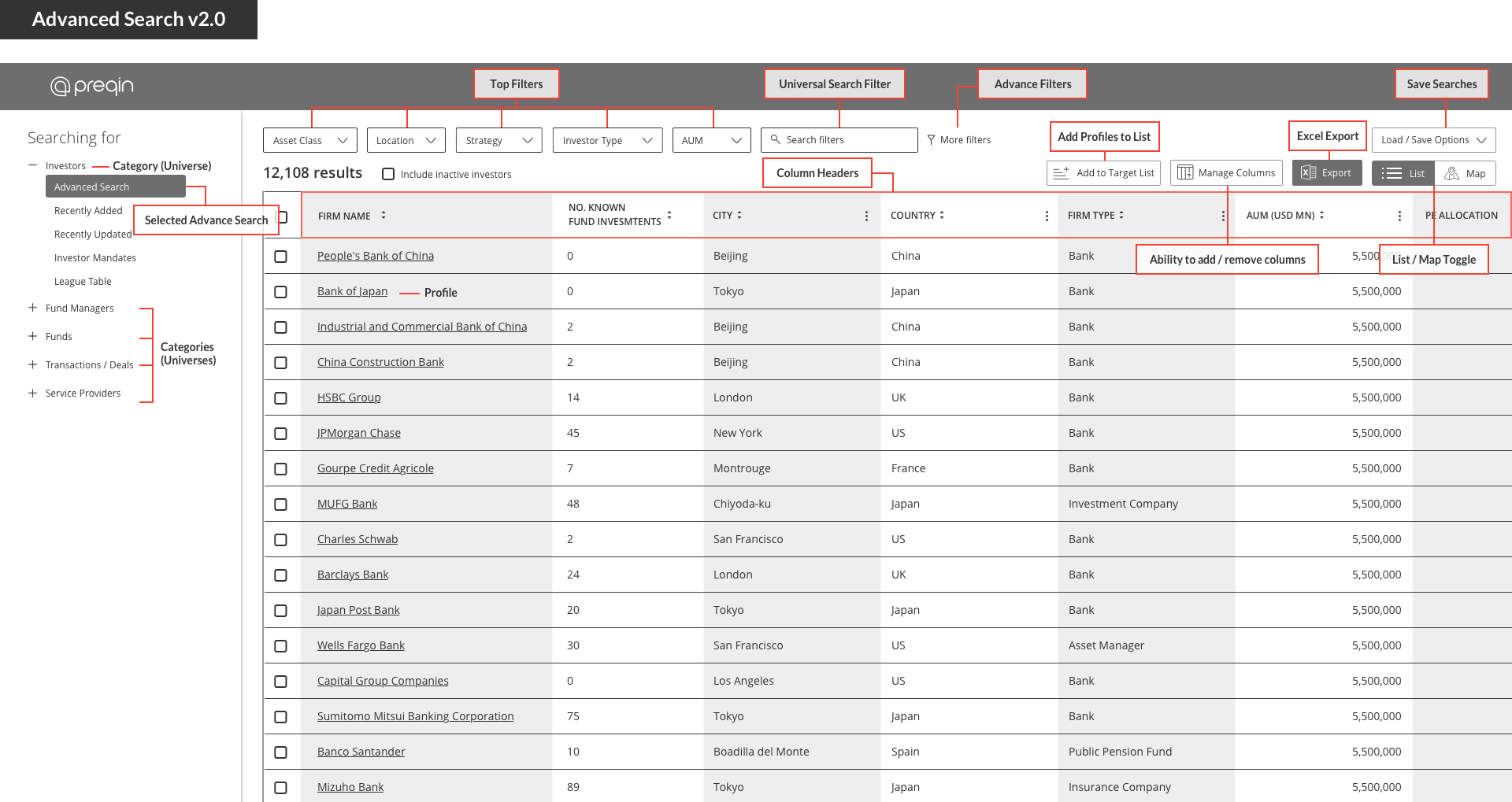

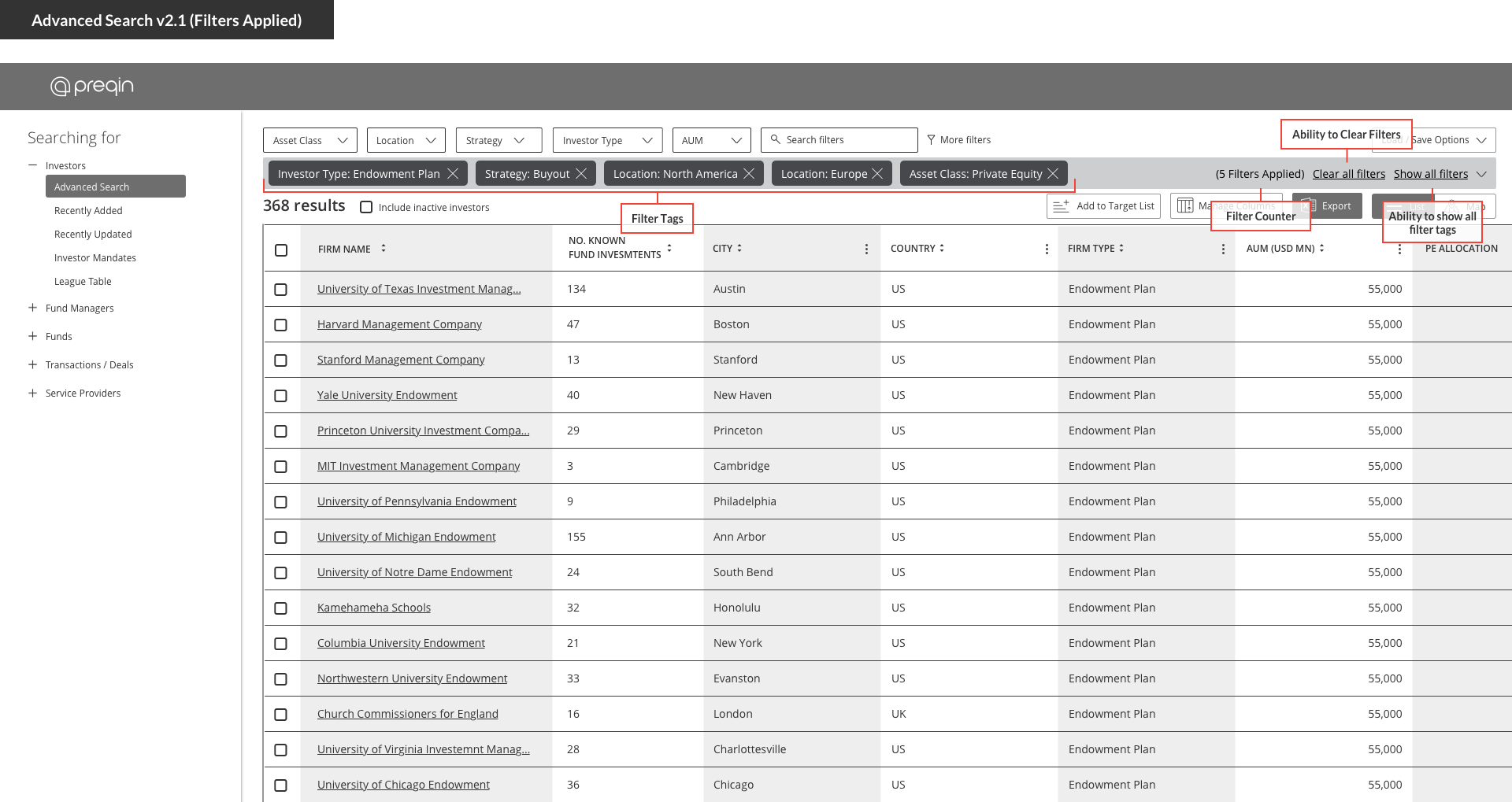

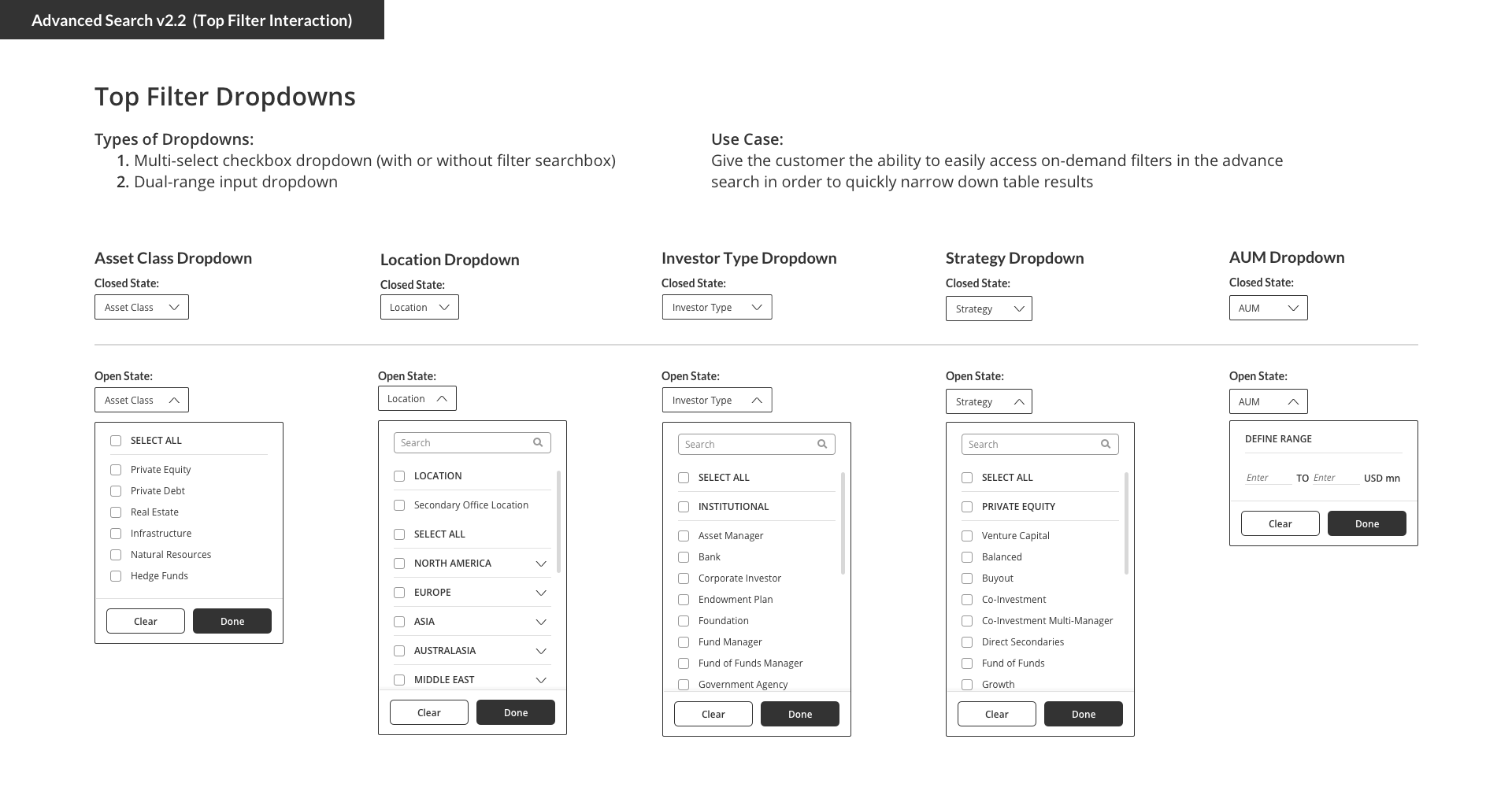

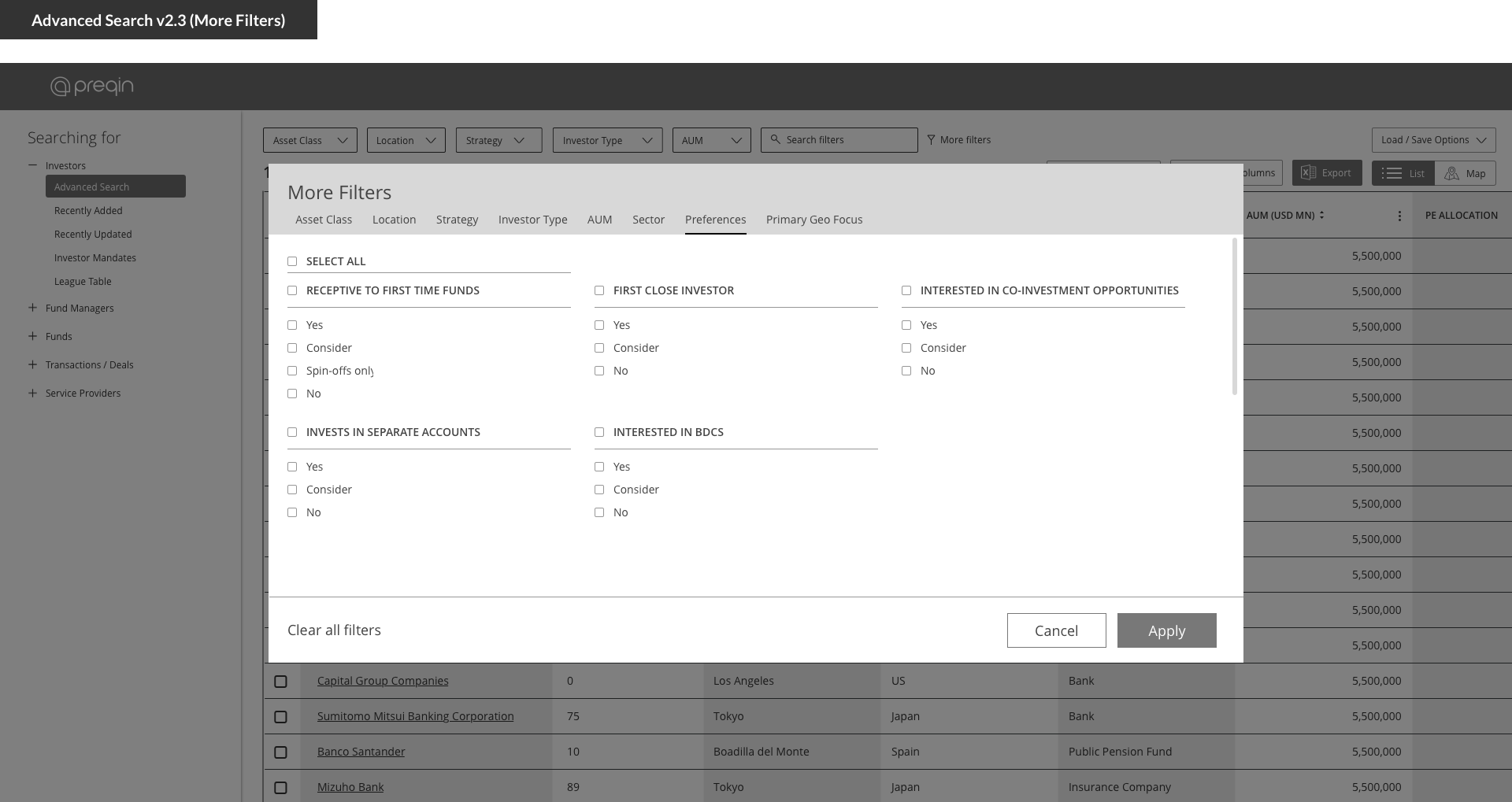

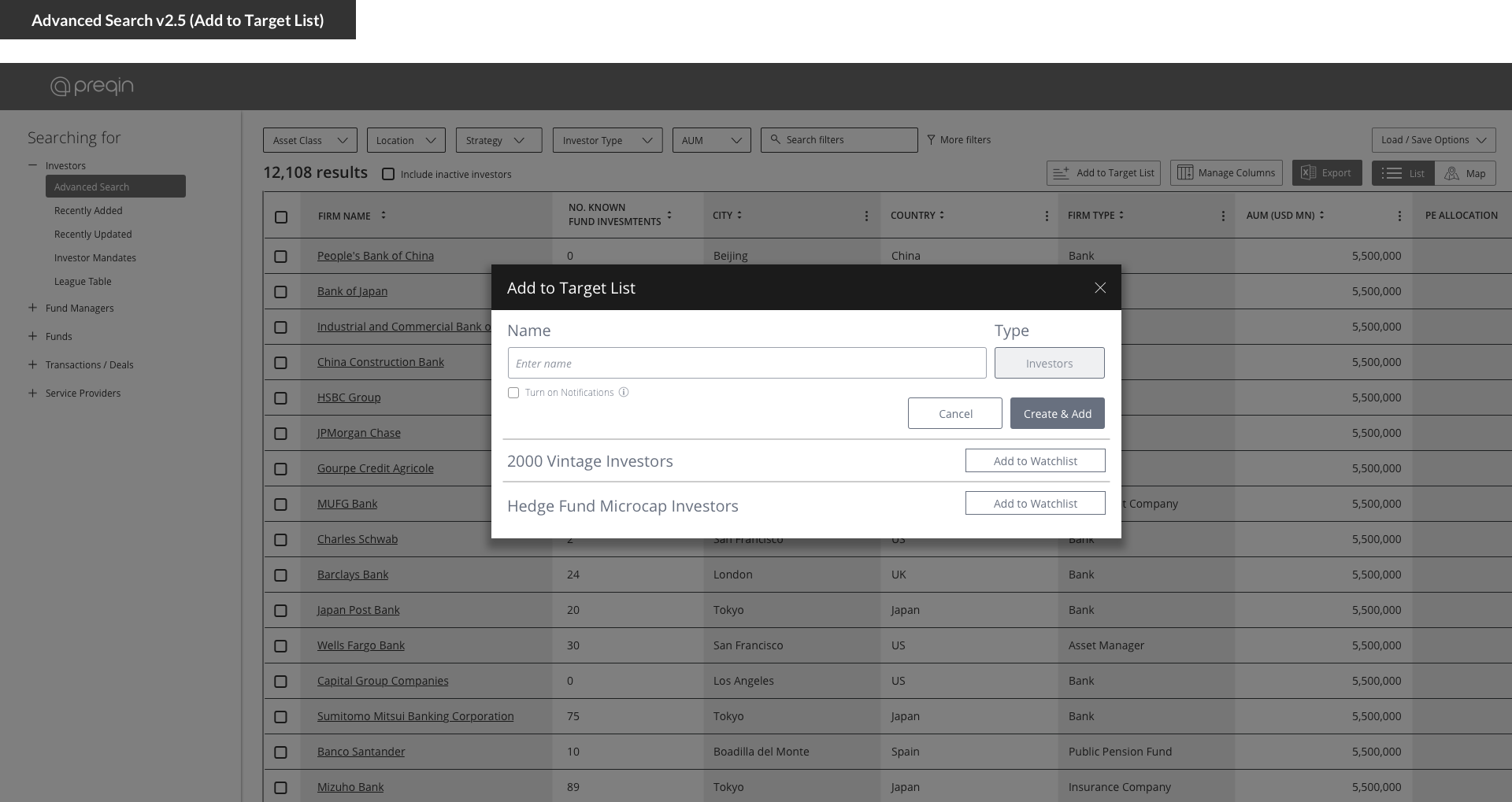

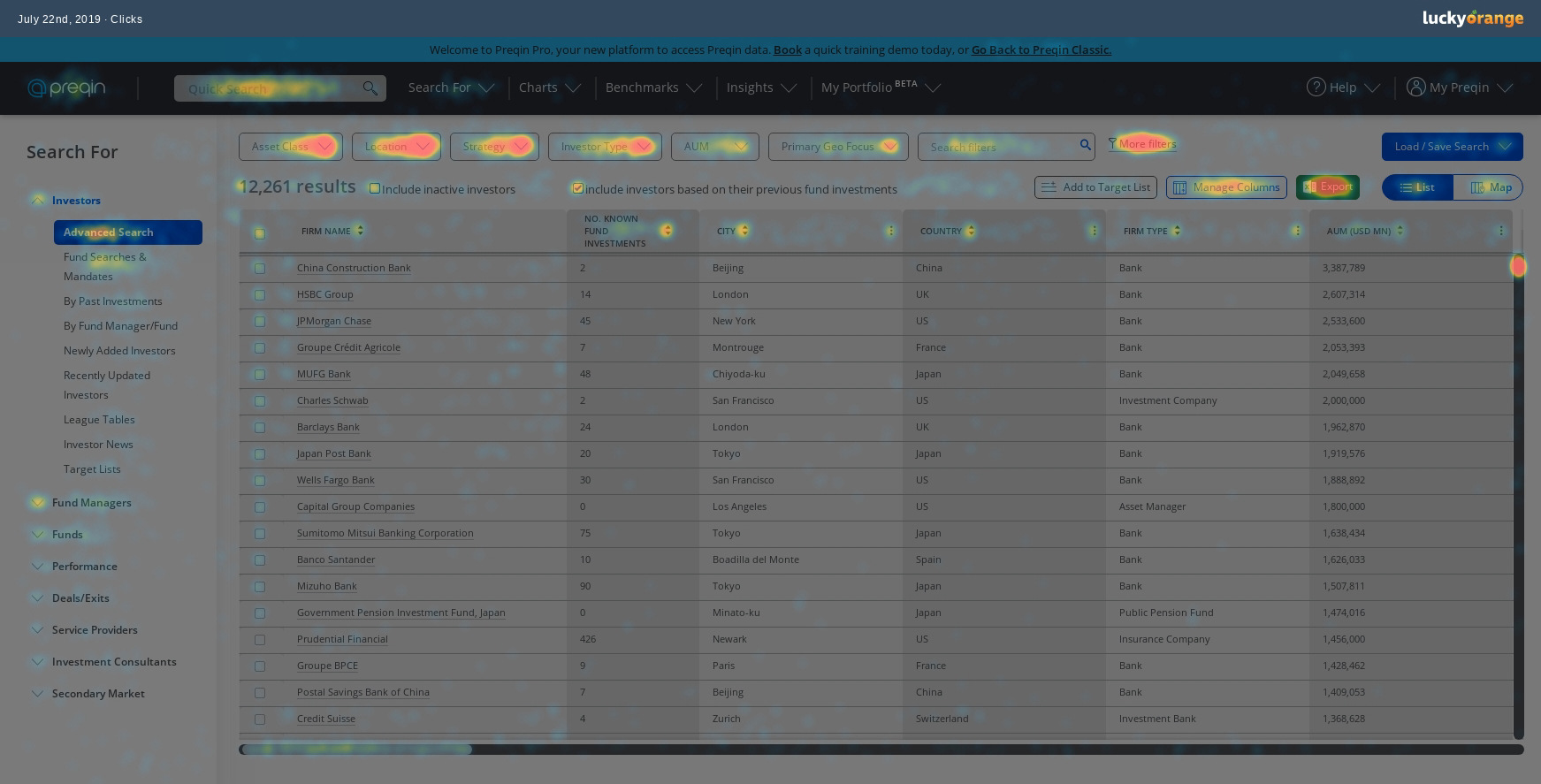

In response to our initial round of customer feedback, we decided to shift directions in respect to the previous wireframes. Our second iteration moved the filters from the left navigation towards the top of the page, above the results table. Based on customer interviews and reviewing past advanced search user heatmaps, we identified 5 filters that were consistently being applied (asset class, investor type, strategy, investor location, and assets under management (AUM)). These five filters became known as 'Top Filters', which serve as a quick way for users to quickly screen and narrow down their results. More importantly, the Asset Class filter addresses our previous user pain point where you can now retrieve a list of results across different asset classes. Furthermore, with the main filtering mechanism shifted to the top, the left side navigation is an area where the customer can dive into different sub-advance searches and access different categories (ie. Investors, Funds, Fund Managers, Investment Consultants).

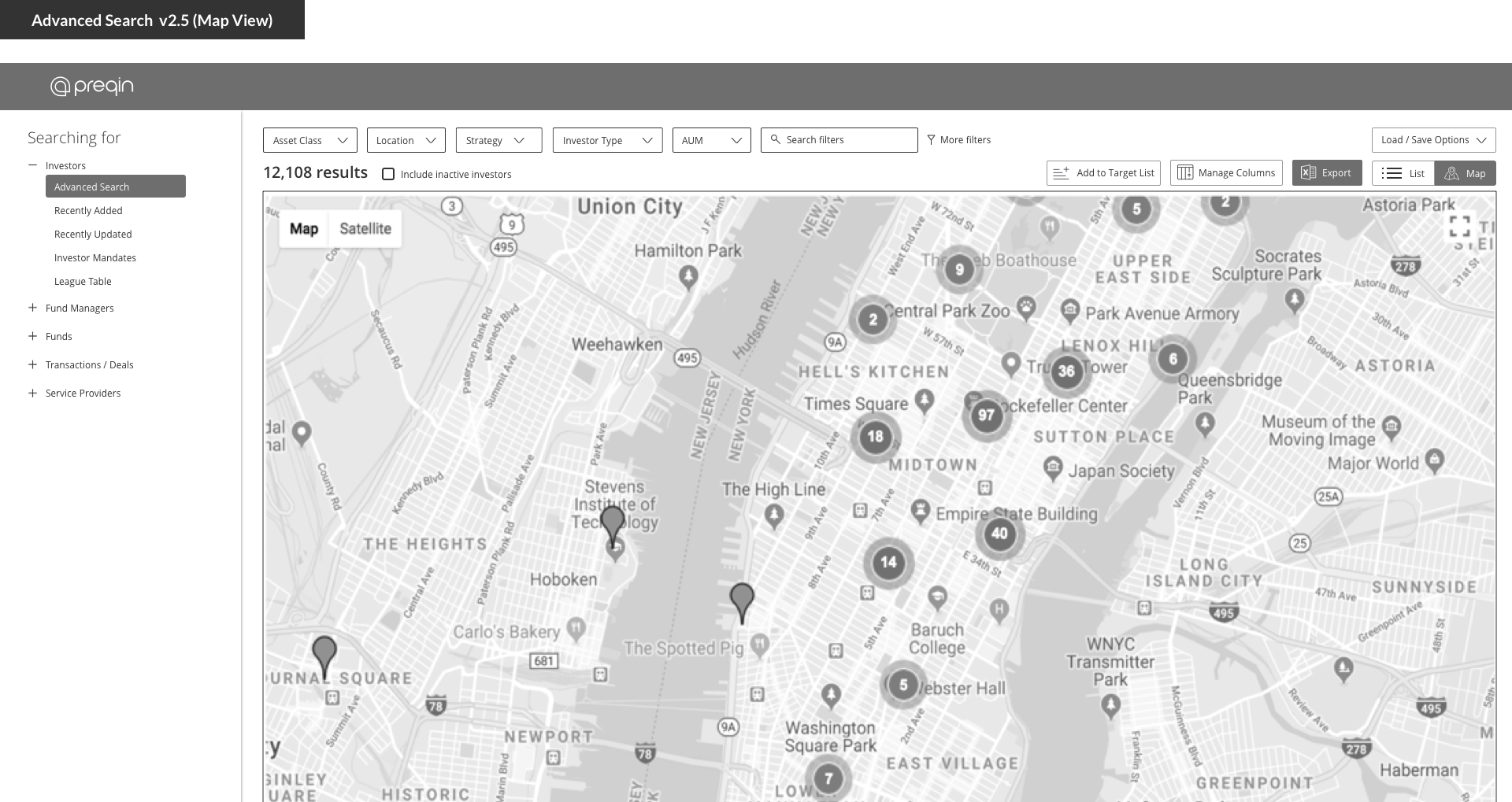

In addition to the navigational changes in filter and advance searches, we added more default columns into the table for the customer to explore and analyze. We also noticed that customers in the past have compiled these lists specifically for roadshows where they plan potential meetings on investment trips, so we decided to incorporate a toggle on the top right of the table where the customer can shift between a list and map view. The map view allows the customer to geographically identify office locations of an investor or fund manager and provide corresponding contact information (ie. phone and email).

Since our official launch of Preqin Pro, the new centralized advanced search ('Search For') has gain significant traction. Investors (#2), Funds (#3), Fund Managers (#4), Performance (#8), and Performance (#9) advance searches all placed within the top 10 most clicked elements after user login. Since advanced searches have been consolidated into one area, we now see more cross asset class analysis and more robust filtering. Customers seem to be quickly adjusting to the new advance search and below is some of the following feedback:

After our intitial launch, we continue to retrieve customer feedback and understand that this is only phase 1 of many iterations going forward. Some notable feedback that we received have been about adding more possible filters and datasets into the advanced search such as narrowing down funds that have used a 'credit facility' or identifying investors that are involved in ESG (Environment, Social, and Governance) type investments.

From a functionality standpoint, customers have stated that they would like faster ways to identify profile names in the advance search tables. As we have seen in the user feedback above, 'Ctrl+F' is limited at this point of time since our tables our lazy loaded, therefore profiles listed beneath the fold aren't searchable on the page. Overall, all feedback is crucial in future iterations / enhancements and ultimately assist on us on making our platform more efficient and accessible to the customer.